Spearheading financial inclusion in Sri Lanka for the past 17 years as one of the foremost NBFIs, Vallibel Finance delivered a definitive financial performance for the fiscal year 2023/24, demonstrating its dynamic industry leadership yet again.

1. PBT grow to Rs. 4.6 billion by 68.1%

2. Assets amass to Rs. 93.2 billion by 13.2%

3. Income grows to Rs. 20.0 billion 19.9%

4. Interest income grows to Rs.18.4 billion17.2%

5. Effective Tax rate increased to 53.9% from 51.5%

The Company recorded a pre-tax profit of Rs. 4.6 billion (68.1% increase yoy) in comparison with Rs. 2.7 billion recorded in 2022/23 In alignment with our unwavering commitment to economic development and national growth, Vallibel Finance is pleased to announce the payment of Rs. 2.5 billion in Corporate Income Tax and Taxes on Financial Services for the fiscal year 2023/24 which is 50% of the total profit. This reflects a significant increase from the Rs. 1.4 billion paid in the previous fiscal year 2022/23.

As of 31st March 2024, total income surged to Rs. 20.03 billion, from Rs. 16.70 billion in 2022/23, primarily driven by revenue from loans and advances. The Gross Loan Portfolio experienced a remarkable turnaround, achieving an 11.2% growth. This growth underscores the strong trust our customers place in the Vallibel brand. All Key Performance Indicators (KPIs) exhibited robust expansion, including fixed deposits, lending, the pawning portfolio, and overall profitability.

The NPL ratio, a measure of nonperforming loans, decreased to 5.88% at the year-end, compared to the 6.16% recorded at the end of the previous financial year. The NPL ratio continues to be significantly lower than the industry average, which is a testament to the company’s strict risk management practices.A 59.9% increase was recorded in Earnings Per Share (EPS) in 2023/24 compared toprevious financial year from 54%. Rs. 5.69 recorded during the previous year.

The prevailing economic conditions challenged the financial stability of some customers and VallibelFinanceexhibited a strong customer focus to alleviate their financial burdens to the greatest extent possible by restructuring customer debts to better reflect their cash flowsthroughloan re-scheduling.

Further, the trust placed with our customers resulted in the expansion of our deposit base to Rs. 58.6 billion, From Rs. 49.6Bn marking a growth of 18.1% in the the2022/23 financialyear. The Company’s total assets increased by 13.2% to Rs. 93.17 Bn compared to the Rs. 82.32 Bn recorded in the previous financial year. Despite facing challenges, the Company’s balance sheet remains robust, a testament to our prudent asset and liability management strategies.

The Managing Director of Vallibel FinanceJayanthaRangamuwa,commented, “Achieving this milestone despite headwinds reflects the robust nature of our people and processes, backed by digital technology and data-driven insights. I am heartened by the selfless contribution by the entire staff in surpassing the targets set for the year. Our closeness to our customer base continues to deepen withthe opening of new branches during 2023/24 to make our services accessible to more Sri Lankans.”

In an endorsement to its robust financial management and strategic planning, Vallibel Finance secured a BBB+ credit rating from the Lanka Rating Agency during the year under review – a powerful validation of its sound business practices. Furthermore, Vallibel Finance also emerged as the Best Finance Company – Sri Lanka Global Economics Awards for the third consecutive year in 2021, 2022 and 2023, which is a notable achievement. It stands as a testimony to the company’s pursuit of excellence despite extenuating circumstances. The award also serves as powerful inspiration for the company to achieve new milestones.

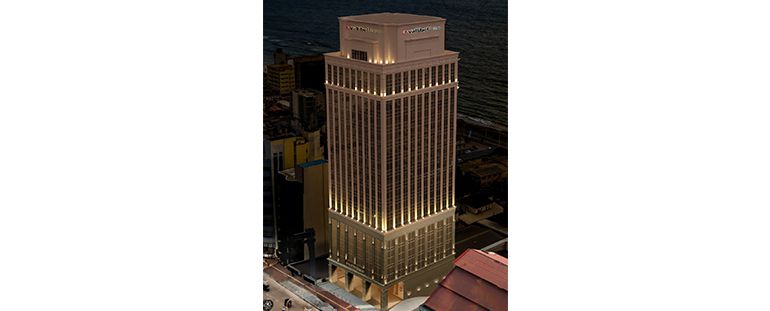

The Vallibel Finance state-of-the-art corporate office within the greater Colombo area shines like a beacon in the skyline, reflecting its unwavering responsibility to excellence and innovation.This state-of-the-art office complex is positioned to be a symbol of excellence within the financial services industry serving as another remarkable milestone for Vallibel Finance as it reiterates its commitment to driving financial sustainability in the country.