30-09-2025

Upgrade reflects its superior asset quality, improved profitability and ambitious expansion plans across Sri Lanka’s finance sector

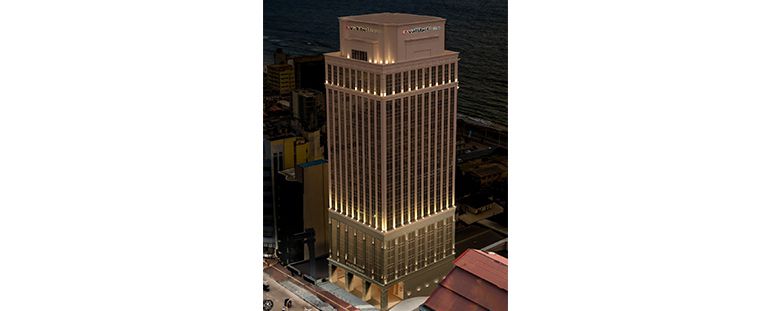

Vallibel Finance PLC (VFIN or the Company), a licensed finance company in Sri Lanka, has been upgraded by Lanka Rating Agency from BBB- to A-, underscoring its robust market outreach, superior asset quality and improved profitability.

Mid-Sized Player with National Footprint

VallibelFinance PLC has crossed a historic milestone of Rs. 100 billion in assets in FY24/25, underscoring its position as one of Sri Lanka’s most trusted and high-performing financial services brands.This milestone reflects the strength of a brand built on integrity, innovation and impact.

Vallibel Finance’s brand promise is to be a financial partner that understands the aspirations of Sri Lankans: from small businesses looking to expand, to families seeking financial stability, to young entrepreneurs chasing their dreams.

Accounting for about 5.3 percent of total Licensed Finance Company (LFC) sector assets, VFIN is primarily engaged in vehicle loans, auto drafts, gold loans and leases. Together these segments make up more than 94 percent of its lending portfolio.The rating upgrade recognises the Company’s ability to maintain its non-performing loan (NPL) ratio at industry benchmarks despite rapid portfolio growth, while sustaining strong coverage for impaired loans.

Stronger Financial Performance

Net interest income rose by 15.9 percent to LKR 8,118 million in FY25 (3MFY26: LKR 2,308 million), while net income grew by 22.8 percent to LKR 2,629 million (3MFY26: LKR 785 million), fuelled by higher lease income. Core spreads improved to 7.8 percent from 6.0 percent in FY24 thanks to lower interest rates and liability repricing.

Revenue is predominantly core at 78 percent, with the remaining 22 percent derived from fair value gains, provision write-backs and early-termination income. The loan and lease portfolio expanded from LKR 92,147 million in FY25 to LKR 104,280 million in 3MFY26.

Capital Strength and Risk Management

VFIN’s gearing stood at 6.0x in FY25 (6.9x in 3MFY26). Its Tier I capital adequacy ratio (CAR) was 16.54 percent and Total CAR 21.51 percent in FY25, comfortably above regulatory thresholds but slightly below industry averages. Short-term asset-liability gaps have narrowed, although a wider gap remains in the 1 to 3-year tenor due to debenture maturities.

Aggressive Expansion Strategy

VFIN plans to open 13 new branches in underserved markets to widen access and gain market share. The growth strategy also includes diversifying into margin trading, digital and online services, Islamic banking, and scaling its property loan franchise. Management expects gold loans to comprise one-third of the loan book by FY26/27.

Governance and Board Strength

The Company’s Board comprises seven members — four Independent Non-Executive Directors, one Non-Executive Director (Chairman), and two Executive Directors. Mr. K. D. A. Perera was appointed Chairman in 2023, while Mr. J. Kumarasinghe serves as Senior Independent Director.

Future Ratings Hinged on Sustained Performance

Lanka Rating Agency emphasises that the Company’s future ratings will depend on continued growth, robust governance and steady financial and operational metrics. Any significant increase in NPLs or a decline in capital adequacy ratios could exert downward pressure on the rating.

About Vallibel Finance PLC

Vallibel Finance PLC is a public limited liability company incorporated and domiciled in Sri Lanka and listed on the Colombo Stock Exchange. Following its acquisition by Vallibel Investment (Pvt.) Limited in 2005, it became Vallibel Finance. The Company’s principal activities include accepting deposits, granting finance leases, vehicle loans, auto drafts, gold loans and other credit facilities.

සංස්ථාපිත දිනය : 1974 වර්ෂයේ සැප්තැම්බර් මස 05 වන දින ලියාපදිංචි අංක 526PQ 2011 අංක 42 දරන මුදල් ව්යාපාර පනත යටතේ ශ්රී ලංකා මහා බැංකුවේ මුදල් මණ්ඩලය වෙතින් බලපත්ර ලාභී මුදල් සමාගමකි. Credit Rating : A- (Stable) by Lanka Rating Agency

© for Vallibel Finance by: 230 interactive